B2B: Business to Business There are 12 products.

Privilege your professional customers by allowing them to buy without taxes, by placing them in groups of privileged customers.

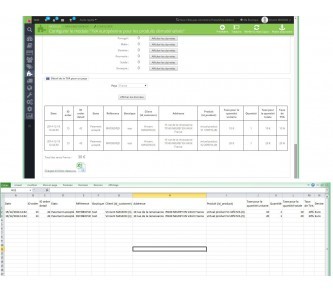

SQL Backup (manual/CRON/mail)

This module allows you to make SQL backups very easily from the back office, but also by CRON task with sending a copy of the database (.sql.bz2 file) by email to the administrators of your choice

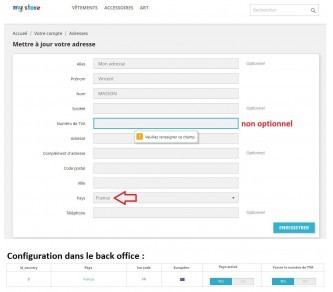

Force the VAT number depending on the country

This module allows you to force the customer to register their VAT number depending on the country, so you can force foreigners in your country to register their VAT number.

VAT number

Invoice tax-free foreign business customers who have a valid VAT number on VIES after verifying the VAT numbers to avoid VAT scams and customer errors.

Mini One-stop shop

Put yourself in accordance with the new rule for applying the VAT with European customers and simplify your life with a summary of VAT for each country based on the start and end dates and the order status.

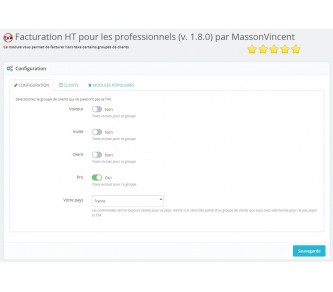

Invoicing HT (without VAT) for pros (1.6 &...

This module allows you to invoice the groups of customers of your choice excluding VAT and to connect to customer accounts without knowing their password (superuser) in order to check the result.

Billing HT (without VAT) for professionals...

You have professional clients and individuals on your prestashop store? This module will allow you to charge VAT for professionals and TTC for individuals.?

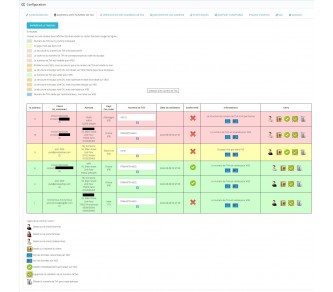

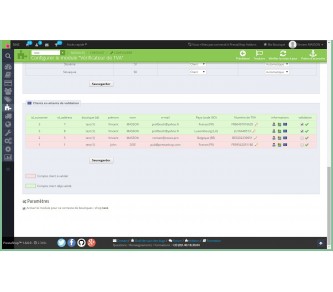

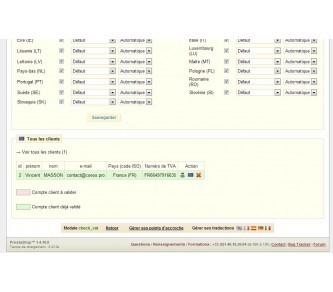

VAT management and customer group by country...

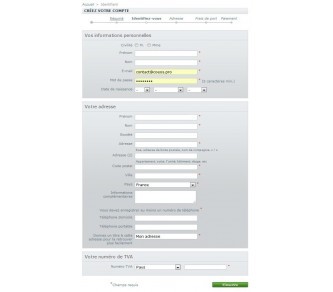

This module will allow you to force or not the customer to enter their VAT number when registering or for customers déjas inscits. Once the VAT number indicated (and valid) the client can be chnage group according to its country of automatically or manually.

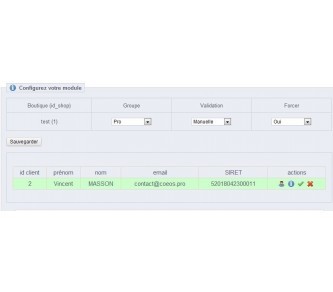

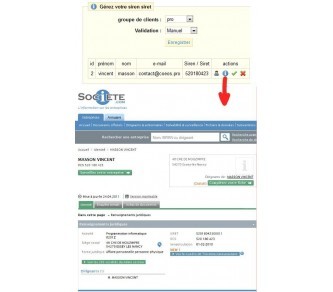

SIRET and customer group

This module allows customers to record their SIRET registration or in their account and be transferred after auto-commit (or manual) in a group of client of your choice.

VAT management and customer group by country...

This module will allow you to force or not the customer to enter their VAT number when registering or for customers déjas inscits. Once the VAT number indicated (and valid) the client can be chnage group according to its country of automatically or manually.

VAT management and customer group by country...

This module will allow you to force or not the customer to enter their VAT number when registering or for customers déjas inscits. Once the VAT number indicated (and valid) the client can be chnage group according to its country of automatically or manually.

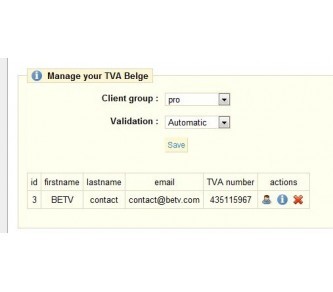

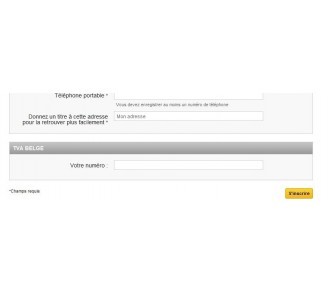

Belgian VAT

This module allows your customers to fill their VAT BE in their account and thus be assigned to the corresponding occupational category. This change in the choice group is automatic or manual. Only valid VAT BE codes are recorded.

SIREN - SIRET

This module allows your customers to inform them and SIREN SIRET in their account and thus be assigned to the same professional category. This change in the choice group is automatic or manual. Only valid SIRET code SIREN and are saved.